Warrants

What is a stock right?

Typically companies offer one right per share currently held by existing shareholders and often require redemption of multiple right to buy shares of the new offering within a reasonably short period of time; generally 30 to 60 days. The rights are initially attached to the original share of stock but can be detached and traded seperately during the offering period, ultimately expiring without value if not used to purchase the new shares. The strike price of the right - the price at which new shares can be purchased - is always set below the current market price of the stock thereby ensuring that all rights have an intrinsic value from the offset.

What is a stock warrant?

Warrants may be used to purchase additional shares of a company stock.

Warrants are normally attached to bonds rather than stock and are intended to induce investors to purchase a companies debt, knowing that they may later have the opportunity to obtain an equity position and benefit from the companies future prospects.

Warrants have expiration dates normally from 6 months to a year.

The strike prices of warrants are normally set ABOVE the current market price of the underlying security (to discourage investors form immediate exercise).

Warrants may also be detached from the bonds with which they are issued and can trade on the open market.

Warrant holders have a few options including

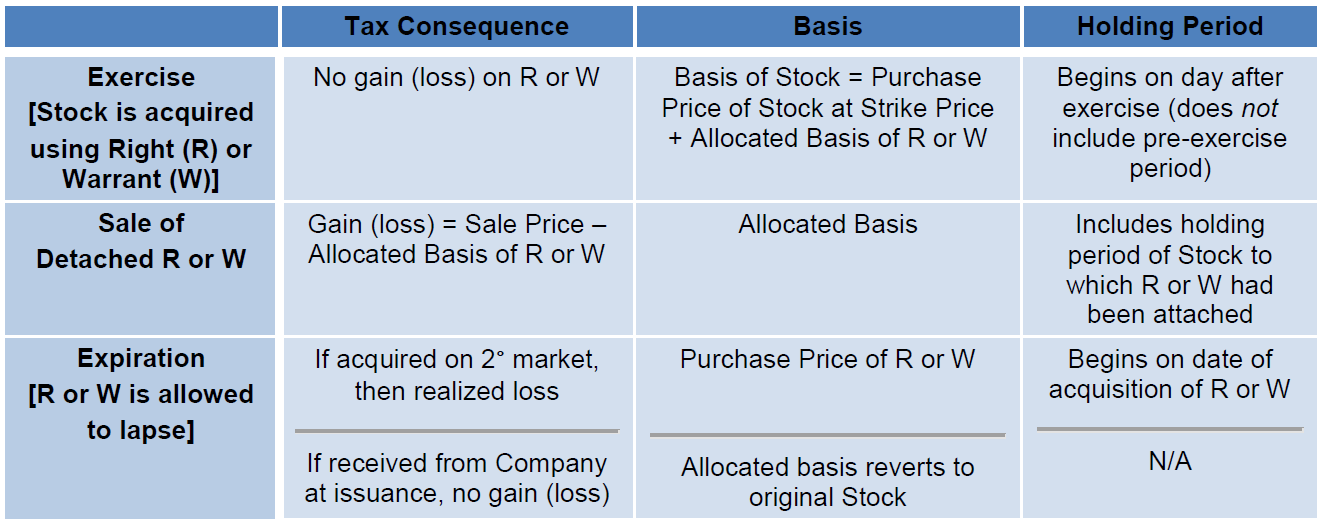

Exercise the warrants to obtain stock.

Sell their warrants.

Allow their warrants to expire.

How is the acquisition of a stock warrant taxed?

Rights and warrants are normally non-compensatory in nature, meaning that they are not granted to employees for services provided - thus the investor is not taxed at the time of receipt. therefore the basis is normally zero unless the investors choose to apportion a part of the basis of the stock or bond to which the warrant/right was attached.