What is the state sourcing on Non- Qualified Deferred Compensation?

NQDC technically should follow state sourcing, meaning was the employee traveling to multiple states in the year he/she deferred the comp into the NQDC although most employers report it to your resident state...

if you move out of state when collecting payments your state where you earned it will tax you on it unless you elect to receive the payment in 10 or more annual installments - so for example you earned NQDC while working in NJ but in retirement you move to FL and select the 10 year payout - NJ can't tax you on it because per federal law it becomes a 'pension'. (Source Below)

https://www.congress.gov/104/plaws/publ95/PLAW-104publ95.pdf

Participating in an NQDC plan: key considerations -

To get the most benefit out of an NQDC plan, you must give careful thought to your deferral strategy, investment options, and distribution plan. Non-qualified distribution investing and distribution strategies delve into how to approach those decisions. But before you tackle these issues, you must first decide whether to participate in your company’s NQDC plan at all.

Here are six important questions to ask yourself when deciding whether an NQDC plan is right for you:

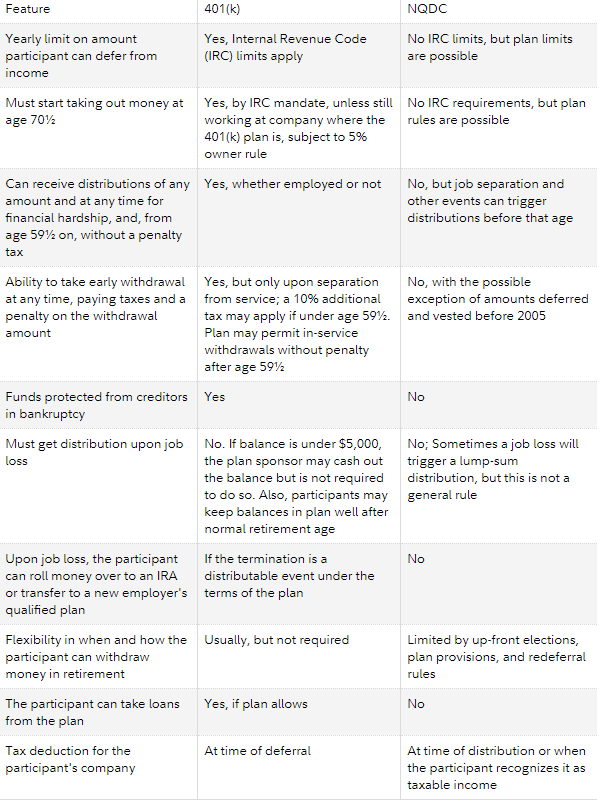

Do I annually maximize my contributions to traditional retirement plans? You should make the maximum contribution to a 401(k) or 403(b) plan each year before enrolling in an NQDC plan. IRS Section 401(k) and 403(b) plans are funded directly and are protected under the Employee Retirement Income Security Act, while an NQDC plan is not.

Will my tax rate change in the future and can I afford to defer compensation? You don’t pay income taxes on deferred compensation until you receive those funds. Participation is more appealing if you expect to be in a lower tax bracket when you retire (or whenever you plan to receive a distribution from the plan). Look closely at your cash flow needs and upcoming expenses to estimate whether you can afford to forgo income you expect in the coming years. After you’ve selected a deferral amount (it must be a year ahead), the decision is irrevocable.

Is the company financially secure? You need to feel confident that your employer will be able to honor this commitment down the line.

Does the plan allow a flexible distribution schedule? Some plans require you to defer compensation until a specified date, which could be during retirement. Other plans allow for earlier distributions. Depending on your personal situation and income needs, greater flexibility with distribution elections can be a significant advantage. Also, the employer may force payments as a lump-sum distribution.

What investment choices does the plan offer? Some plans promise a fixed rate of return on deferred compensation, but that practice is rare. Instead, most companies base the growth of deferred compensation on the returns of specific notional investments. For example, some NQDC plans offer the same investment choices as those in the company 401(k) plan. Others allow you to follow major stock and bond indexes. The more investment choices available to you, the easier it is to fit an NQDC plan into your diversified investment strategy.

Is NQDC plan participation appropriate for me? Can you afford to lose the money? Do you have substantial wealth outside the NQDC plan? Do you understand the risks? If the answer to all these questions is yes, then NQDC plan participation may potentially be appropriate for you.

Giving thought to the preceding questions may help you decide whether an NQDC plan is a good fit for your financial needs.

FICA tax rules for nonqualified deferred plan annuity payments -

July 31, 2017

Information Letter 2017-0012

IRS has issued an information letter on the FICA tax rules with respect to nonqualified deferred compensation plan annuity payments.

Background—nonqualified deferred compensation plans. A nonqualified deferred compensation (NQDC) plan is an arrangement between an employer and an employee to pay the employee compensation in the future. NQDC plans are generally unfunded arrangements. This means the employer’s promise to pay the deferred compensation benefits in the future is not secured in any manner. An inherent feature of nonqualified deferred compensation plans is the risk that an employee may not receive any benefits in the future.

NQDC arrangements are either account balance plans or nonaccount balance plans. A nonaccount balance plan does not credit deferred amounts to a particular participants’ individual account. (Reg. § 31.3121(v)(2)-1(c)(1)(i))

Background—FICA taxation of NQDC plans. Generally, wages are subject to FICA tax (Social Security and Medicare tax) when they are actually or constructively paid (see Code Sec. 3101 and Code Sec. 3111). However, a special timing rule allows an employer to withhold the employee share of FICA tax, and pay the employer share of FICA tax, on amounts deferred under a NQDC plan as of the later of: (1) the date on which the employee performs the services that create the right to a deferral; or (2) the date on which the amount deferred is no longer subject to a substantial risk of forfeiture (Code Sec. 3121(v)(2))

Nonaccount balance plans are subject to a special rule that allows an amount deferred under a nonaccount balance plan to not be taken into account as FICA wages until the amount deferred is considered “reasonably ascertainable.” The amount deferred is “reasonably ascertainable” on the first date on which the amount, form, and beginning date of the benefit are known, so that its present value can be computed. (Reg. § 31.3121(v)(2)-1(e)(4))

Taxes or other amounts which an employer is required or authorized to deduct and pay to the U.S., a state or any political subdivision of the U.S. or a state don’t reduce the amount of wages for FICA purposes. (Code Sec. 3123)

Facts. A taxpayer is receiving annuity payments under a NQDC nonaccount balance plan. The employer paid both the employer and employee FICA taxes on the present value of the NQDC benefits in the year he began receiving distributions under the plan. The taxpayer is concerned that the employee share of FICA tax on the present value of his NQDC benefit was included in his income.

The employer handled things properly. IRS first said that the employer had properly computed both the employer and employee share of FICA tax on the annuity payments in accordance with federal law and regs. IRS also stated that the employer was correct to include in the employee’s income the employee share of FICA tax on the present value of his nonqualified deferred compensation benefit. IRS cited Code Sec. 3123 and noted that amounts withheld from an employee’s wages for the employee share of FICA tax are treated as paid to the employee. As a result, the amount withheld by the employer as the employee share of FICA tax should be included in the employee’s income.

IRS also pointed out that this situation is different from the situation where the employer pays the employee share of FICA tax out of its own funds instead of withholding it from the employee’s wages. In that situation, the employee must include in income both the amount that the employer should have withheld as the employee share of FICA tax and the additional amount paid by the employer out of its own funds.

In addition, IRS noted that the intent of Code Sec. 3121(v)(2) is to impose FICA tax on amounts deferred under a NQDC arrangement when the amounts become vested in the employee (that is, not subject to a substantial risk of forfeiture). The fact that the employee later receives less than the amount originally deferred (or ultimately receives nothing at all) does not give the employee a right to a refund of the FICA taxes paid on amounts deferred.

References: For the special timing rule for NQDC plans, see FTC 2d/FIN ¶ H-4635 ; United States Tax Reporter ¶ 409A4.04 .