Non-Resident Aliens (Generally speaking)

When would a NRA be required to file a US tax return?

Pub 519 Page 10

A resident alien's income is generally subject to tax in the same manner as a U.S. citizen. If you are a resident alien, you must report all interest, dividends, wages, or other compensation for services, income from rental property or royalties, and other types of income on your U.S. tax return. You must report these amounts from sources within and outside the United States.

1040nr instructions page 3… who must file.

http://www.irs.gov/pub/irs-pdf/i1040nr.pdf

http://www.irs.gov/Individuals/International-Taxpayers/Taxation-of-Nonresident-Aliens

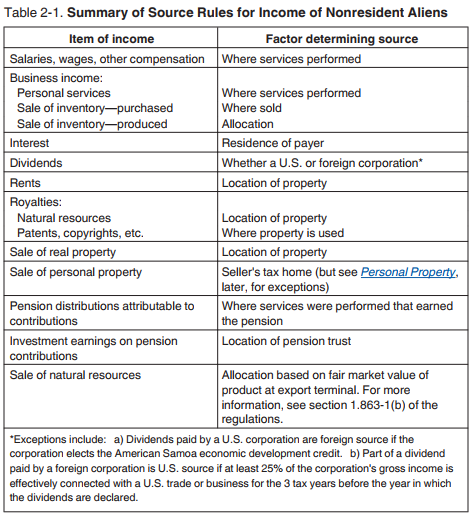

What types of income would be classified as US sourced income for a NRA?

1040NR page 8 right hand side

PUB 519 page 10

What is the withholding rate for US sourced income for a NRA?

Form 1042 S

http://www.irs.gov/pub/irs-pdf/f1042s.pdf

http://www.irs.gov/Individuals/International-Taxpayers/NRA-Withholding 30% but any “Treaty” is out of our scope.

How many days does a NRA need to be physically present in the US to be reclassified as a Resident Alien?

PUB519 page 4 left hand side

Green card OR

Substantial Presence Test - You will be considered a U.S. resident for tax purposes if you meet the substantial presence test for calendar year 2014. To meet this test, you must be physically present in the United States on at least: 1. 31 days during 2014, and 2. 183 days during the 3-year period that includes 2014, 2013, and 2012, counting: a. All the days you were present in 2014, and b. 1/3 of the days you were present in 2013, and c. 1 6 of the days you were present in 2012.

What assets are classified as US based for NRA estate taxation?

i706na – page 3 middle - gross income report on schedule A

http://www.irs.gov/Individuals/International-Taxpayers/Nonresident-Aliens---Source-of-Income

Is corporate bond interest subject to US taxation for a NRA?

Pub 519 page 15 – portfolio interest

US corps are subject to 30% rate

NOT

Interest Income - Generally, U.S. source interest income includes the following items. Interest on bonds, notes, or other interest-bearing obligations of U.S. residents or domestic corporations. Interest paid by a domestic or foreign partnership or foreign corporation engaged in a U.S. trade or business at any time during the tax year. Original issue discount. Interest from a state, the District of Columbia, or the U.S. Government.

Can you review receiving an inheritance from a NRA?

http://www.law.cornell.edu/uscode/text/26/102

Regardless of the amount or the source.

Form 3520 instructions must file.

http://www.irs.gov/Businesses/Comparison-of-Form-8938-and-FBAR-Requirements

No capital gains tax on NRA’s.

1 – Who is considered a foreign person for U.S. income taxes?

A foreign person is a nonresident alien individual, foreign corporation that has not made an election under section 897(i) of the Internal Revenue Code to be treated as a domestic corporation, foreign partnership, foreign trust, or foreign estate. It does not include a resident alien individual or, in certain cases, a qualified foreign pension fund.

https://www.irs.gov/pub/irs-pdf/p515.pdf - Page 46

Nonresident Aliens: If you are an alien (not a U.S. citizen), you are considered a nonresident alien unless you meet one of the two tests described next under Resident Aliens.

Resident Aliens: You are a resident alien of the United States for tax purposes if you meet either the green card test or the substantial presence test for calendar year 2016 (January 1–December 31).

Green Card Test: You are a resident for tax purposes if you are a lawful permanent resident of the United States at any time during calendar year 2016. You are a lawful permanent resident of the United States at any time if you have been given the privilege, according to the immigration laws, of residing permanently in the United States as an immigrant. You generally have this status if the U.S. Citizenship and Immigration Services (USCIS) (or its predecessor organization) has issued you an alien registration card, also known as a “green card.” You continue to have resident status under this test unless the status is taken away from you or is administratively or judicially determined to have been abandoned.

Substantial Presence Test: You will be considered a U.S. resident for tax purposes if you meet the substantial presence test for calendar year 2016. To meet this test, you must be physically present in the United States on at least:

1. 31 days during 2016, and

2. 183 days during the 3-year period that includes 2016, 2015, and 2014, counting:

a. All the days you were present in 2016, and

b. 1/3 of the days you were present in 2015, and

c. 1/6 of the days you were present in 2014.

Dual-Status Aliens: You can be both a nonresident alien and a resident alien during the same tax year. This usually occurs in the year you arrive in or depart from the United States.

https://www.irs.gov/pub/irs-pdf/p519.pdf

2 – What is included in gross income?

A nonresident alien usually is subject to U.S. income tax only on U.S. source income. Under limited circumstances, certain foreign source income is subject to U.S. tax. There are two different U.S. income tax regimes that apply to foreign individuals.

First, foreign individuals are taxed on income that is ‘effectively connected’ (“effectively connected income” or ECI) with a trade or business in the United States. Such income is taxed at the applicable U.S. individual or corporate tax rates on a net basis; that is, deductions allocable to that income are allowed.

On the other hand, nonresident alien individuals and foreign corporations are subject to withholding tax on a gross basis on U.S. source income not effectively connected with the conduct of a trade or business within the United States (aka FDAP – fixed or determinable annual or periodical) under §§ 871(a) and 881. This income is subject to withholding on the gross amount of the payment, without any deductions, at a rate of 30%. Examples of FDAP income include interest, dividends, rents and royalties. The 30% withholding tax is due under §§ 1441 and 1442 at the time of payment. The 30 percent withholding tax may be reduced or eliminated by bilateral income tax treaties with the United States.

https://www.irs.gov/pub/irs-pdf/p519.pdf

https://www.irs.gov/pub/irs-pdf/p515.pdf

https://www.irs.gov/pub/int_practice_units/rpw_t_08_01_01_01-01r.pdf

3- What is excluded from gross income?

Nonresident aliens can exclude the following items from their gross income subject to certain rules and limitations:

a. Interest income

b. Dividend income

c. Services performed for foreign employer

d. Gambling winnings from dog or horse racing

e. Gain from sale of your main home

f. Scholarships and fellowship grants

g. Capital Gains

Interest: Nonresident aliens are not taxed on certain kinds of interest income as follows, per Internal Revenue Code subsections 871(h) and (i), provided that such interest income arises from one of the following sources:

A U.S. bank

A U.S. savings and loan association

A U.S. credit union

A U.S. insurance company

Portfolio Interest

Dividend: The following dividend income is exempt from the 30% tax:

I. U.S. source dividends you receive from a foreign corporation

II. Interest-related dividends from sources within the United States that you receive from a mutual fund or other regulated investment company. The mutual fund will designate in writing which dividends are interest-related dividends

III. Certain short-term capital gain dividends from sources within the United States that you receive from a mutual fund or other regulated investment company. The mutual fund will designate in writing which dividends are short-term capital gain dividends. This tax relief will not apply to you if you are present in the United States for 183 days or more during your tax year.

https://www.irs.gov/individuals/international-taxpayers/certain-types-of-nontaxable-interest-income https://www.irs.gov/pub/irs-pdf/p519.pdf

4- What is Portfolio Interest?

The 30 percent withholding tax does not apply to “portfolio interest” earned by a nonresident alien or foreign corporation. This is commonly referred to as the “portfolio interest exemption.” To qualify as portfolio interest, the interest must be paid on obligations issued after July 18, 1984, and otherwise subject to withholding. For obligations issued after March 18, 2012, portfolio interest does not include interest paid on debt that is not in registered form (see IRS Notice 2012-20). Before March 19, 2012, portfolio interest included interest on certain registered and nonregistered (bearer) bonds if the obligations met certain requirements.

An obligation is in registered form if:

i. the obligation is registered as to both principal and any stated interest with the issuer (or its agent) and any transfer of the obligation may be effected only by surrender of the old obligation and reissuance to the new holder;

ii. the right to principal and stated interest with respect to the obligation may be transferred only through a book entry system maintained by the issuer or its agent; or

iii. the obligation is registered as to both principal and stated interest with the issuer or its agent and can be transferred both by surrender and reissuance and through a book entry system.

An obligation that would otherwise be considered to be in registered form is not considered to be in registered form as of a particular time if it can be converted at any time in the future into an obligation that is not in registered form.

Obligations not in registered form:

For obligations issued before March 19, 2012, interest on an obligation that is not in registered form (bearer obligation) is portfolio interest if the obligation is foreign targeted. A bearer obligation is foreign targeted if:

· There are arrangements to ensure that the obligation will be sold, or resold in connection with the original issue, only to a person who is not a United States person,

· Interest on the obligation is payable only outside the United States and its possessions, and

· The face of the obligation contains a statement that any United States person who holds the obligation will be subject to limits under the United States income tax laws.

Portfolio interest does not include contingent interest. Contingent interest is either of the following:

1. Interest that is determined by reference to:

a. Any receipts, sales, or other cash flow of the debtor or related person,

b. Income or profits of the debtor or related person,

c. Any change in value of any property of the debtor or a related person, or

d. Any dividend, partnership distributions, or similar payments made by the debtor or a related person.

2. Any other type of contingent interest that is identified by the Secretary of the Treasury in regulations.

https://www.irs.gov/pub/int_practice_units/rpw_t_08_01_01_01-01r.pdf