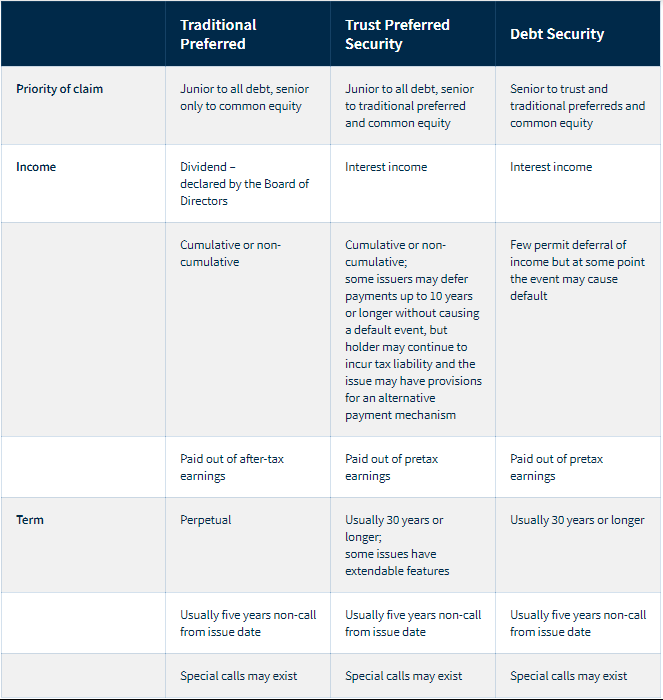

In general, there are three types of preferred securities, each of which share characteristics of both stocks and bonds: equity preferreds, trust or hybrid preferreds, and debt securities.

Equity Preferreds – Traditional or equity preferred stocks are similar to common stock in that they are perpetual and never mature. Like bonds, most pay fixed payments, however the payments are dividends rather than interest.

Trust or Hybrid Preferreds – may pay interest like bonds, however those payments may be deferred or even eliminated under some circumstances without constituting a default event. Unlike bonds, many have a par value of $25, although some have $1,000 par value.

Debt Securities – Often referred to as ‘baby bonds’ due to their par value of $25, they pay interest like traditional bonds. Since they are debt, they stand ahead of equity preferred securities in the payout hierarchy should a company default. Debt preferreds may be secured, unsecured, senior, junior or subordinated in standing within the capital structure.