All income is taxable unless there is a reason to exclude it.

-How does the mortgage interest deduction work?

Interest paid on a mortgage taken out to buy build or improve a primary or secondary residence is deductible as an itemized deduction if the loan is secured by the home.

Mortgages in place after Dec 15, 2017 – Only the interest associated with the first 750,000 of home acquisition debt is deductible.

Mortgages purchased before Dec 15, 2017 – The interest associated with the first 1 million of home acquisition debt is deductible

NOTE: Acquisition debt is defined as a loan taken out to buy build or improve the home, and the loan is secured by the home.

-Is the interest on home equity debt deductible?

Under prior tax law, interest on home equity debt up to 100,000 was deductible as mortgage interest regardless of what the home equity debt was used for. Under new law, home equity debt is only deductible if it qualifies as home acquisition debt which is defined above in the previous question.

The following examples illustrate these points.

Example 1: In January 2018, a taxpayer takes out a $500,000 mortgage to purchase a main home with a fair market value of $800,000. In February 2018, the taxpayer takes out a $250,000 home equity loan to put an addition on the main home. Both loans are secured by the main home and the total does not exceed the cost of the home. Because the total amount of both loans does not exceed $750,000, all of the interest paid on the loans is deductible. However, if the taxpayer used the home equity loan proceeds for personal expenses, such as paying off student loans and credit cards, then the interest on the home equity loan would not be deductible.

Example 2: In January 2018, a taxpayer takes out a $500,000 mortgage to purchase a main home. The loan is secured by the main home. In February 2018, the taxpayer takes out a $250,000 loan to purchase a vacation home. The loan is secured by the vacation home. Because the total amount of both mortgages does not exceed $750,000, all of the interest paid on both mortgages is deductible. However, if the taxpayer took out a $250,000 home equity loan on the main home to purchase the vacation home, then the interest on the home equity loan would not be deductible.

Example 3: In January 2018, a taxpayer takes out a $500,000 mortgage to purchase a main home. The loan is secured by the main home. In February 2018, the taxpayer takes out a $500,000 loan to purchase a vacation home. The loan is secured by the vacation home. Because the total amount of both mortgages exceeds $750,000, not all of the interest paid on the mortgages is deductible. A percentage of the total interest paid is deductible (see Publication 936).

-Can I deduct state taxes paid on my tax return?

Starting in 2018, the IRS limits the deduction for state, local and property taxes paid to $10,000. The deduction was not limited in the past.

Ø What are the rules for being able to deduct medical expenses?

Medical expenses in 2019 that are more than 10% of the taxpayer’s AGI are deductible as an itemized deduction. The expenses can be for the taxpayer, taxpayer’s spouse or any person who qualified as a dependent.

-What are the rules for deducting interest on a security-backed loan?

The IRS allows as a deduction for loans that are taken out to purchase investment property. The interest on a security-backed loan used to buy personal property in non-deductible interest. The loan must be used to purchase investment property.

The amount of the deduction is limited to the amount of net investment income of the taxpayer.

-What are the rules for deducting charitable contributions on my tax return?

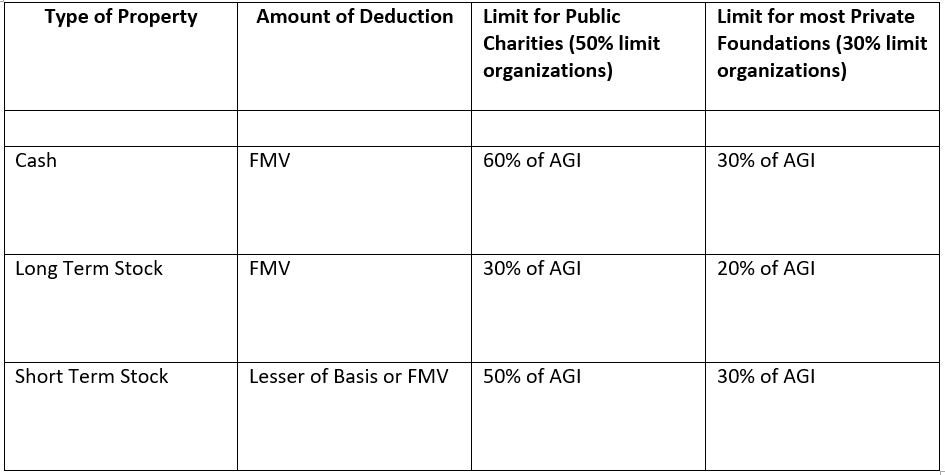

Charitable contributions are allowed in full if they are not more than a certain percentage of the taxpayer’s AGI. Different types of property donated have different AGI limits explained in the chart below

Ø What are the rules for being able to deduct miscellaneous itemized deductions?

Under the new tax law. The deduction for Misc. Itemized deduction subject to the 2% of AGI floor are no longer deductible. This means that investment advisory fees, legal fees, tax prep fees etc. are no longer deductible.

-What are the rules for deducting casualty losses?

Personal casualty losses are not deductible unless they are attributable to a federally declared disaster.

Figuring a Loss –

· 1. Determine your adjusted basis in the property before the casualty or theft.

· 2. Determine the decrease in fair market value (FMV) of the property because of the casualty or theft.

· 3. From the smaller of the amounts you determined in (1) and (2), subtract any insurance or other reimbursement you received or expect to receive

Limits: $100 reduction then reduce the loss after that by 10% of the taxpayer’s AGI. Any remaining loss would be deductible.

HELOC Interest on Home Equity Loans Often Still Deductible Under New Law

WASHINGTON - The Internal Revenue Service today advised taxpayers that in many cases they can continue to deduct interest paid on home equity loans.

Responding to many questions received from taxpayers and tax professionals, the IRS said that despite newly-enacted restrictions on home mortgages, taxpayers can often still deduct interest on a home equity loan, home equity line of credit (HELOC) or second mortgage, regardless of how the loan is labelled. The Tax Cuts and Jobs Act of 2017, enacted Dec. 22, suspends from 2018 until 2026 the deduction for interest paid on home equity loans and lines of credit, unless they are used to buy, build or substantially improve the taxpayer’s home that secures the loan.

Under the new law, for example, interest on a home equity loan used to build an addition to an existing home is typically deductible, while interest on the same loan used to pay personal living expenses, such as credit card debts, is not. As under prior law, the loan must be secured by the taxpayer’s main home or second home (known as a qualified residence), not exceed the cost of the home and meet other requirements.

New dollar limit on total qualified residence loan balance

For anyone considering taking out a mortgage, the new law imposes a lower dollar limit on mortgages qualifying for the home mortgage interest deduction. Beginning in 2018, taxpayers may only deduct interest on $750,000 of qualified residence loans. The limit is $375,000 for a married taxpayer filing a separate return. These are down from the prior limits of $1 million, or $500,000 for a married taxpayer filing a separate return. The limits apply to the combined amount of loans used to buy, build or substantially improve the taxpayer’s main home and second home.

The following examples illustrate these points.

Example 1: In January 2018, a taxpayer takes out a $500,000 mortgage to purchase a main home with a fair market value of $800,000. In February 2018, the taxpayer takes out a $250,000 home equity loan to put an addition on the main home. Both loans are secured by the main home and the total does not exceed the cost of the home. Because the total amount of both loans does not exceed $750,000, all of the interest paid on the loans is deductible. However, if the taxpayer used the home equity loan proceeds for personal expenses, such as paying off student loans and credit cards, then the interest on the home equity loan would not be deductible.

Example 2: In January 2018, a taxpayer takes out a $500,000 mortgage to purchase a main home. The loan is secured by the main home. In February 2018, the taxpayer takes out a $250,000 loan to purchase a vacation home. The loan is secured by the vacation home. Because the total amount of both mortgages does not exceed $750,000, all of the interest paid on both mortgages is deductible. However, if the taxpayer took out a $250,000 home equity loan on the main home to purchase the vacation home, then the interest on the home equity loan would not be deductible.

Example 3: In January 2018, a taxpayer takes out a $500,000 mortgage to purchase a main home. The loan is secured by the main home. In February 2018, the taxpayer takes out a $500,000 loan to purchase a vacation home. The loan is secured by the vacation home. Because the total amount of both mortgages exceeds $750,000, not all of the interest paid on the mortgages is deductible. A percentage of the total interest paid is deductible (see Publication 936).

What is a casualty loss?

PUB 547

Loss is Figuring a Loss - To determine your deduction for a casualty or theft loss, you must firstfigure your loss. Amount of loss. Figure the amount of your loss using the following steps. 1. Determine your adjusted basis in the property before the casualty or theft. 2. Determine the decrease in fair market value (FMV) of the property as a result of the casualty or theft. 3. From the smaller of the amounts you determined in (1) and (2), subtract any insurance or other reimbursement you received or expect to receive

Will taxes paid impact my AMT?

Having more miscellaneous deductions subject to the 2% floor will not effect AMT.

Where do I report investment interest expense?

Taxable interest, ord dividends, short term gains, and long termgains if you forego the preferential

tax treatment. Form 4952 instructions.

If you borrow money to buy tax free bonds…

If you borrow from tax free bonds to buy taxable bonds…

Money is fungible. Automatically not deductible bc its related to the purchase or carry.

http://www.law.cornell.edu/uscode/text/26/265

Are itemized deductions subject to phase-out?

Pease limits

MFJ 309,900 any AGI over

309,900 x 3% = what your itemized deductions will be reduced by.

http://www.irs.gov/pub/irs-pdf/p17.pdf

3% of the amount by which your AGI exceeds $305,050 if married filing jointly or qualifying widow(er), $279,650 if head of household, $254,200 if single, or $152,525 if married filing separately.