Charitable Planning/Giving

Pub 526

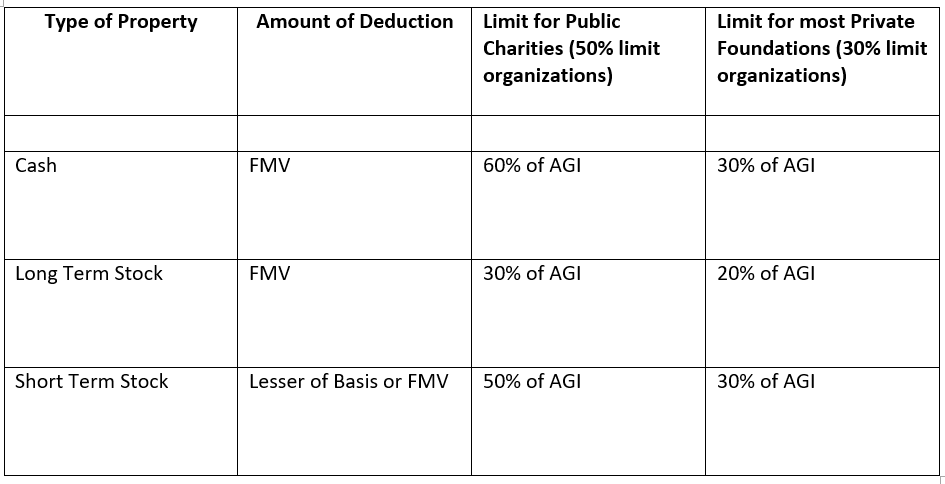

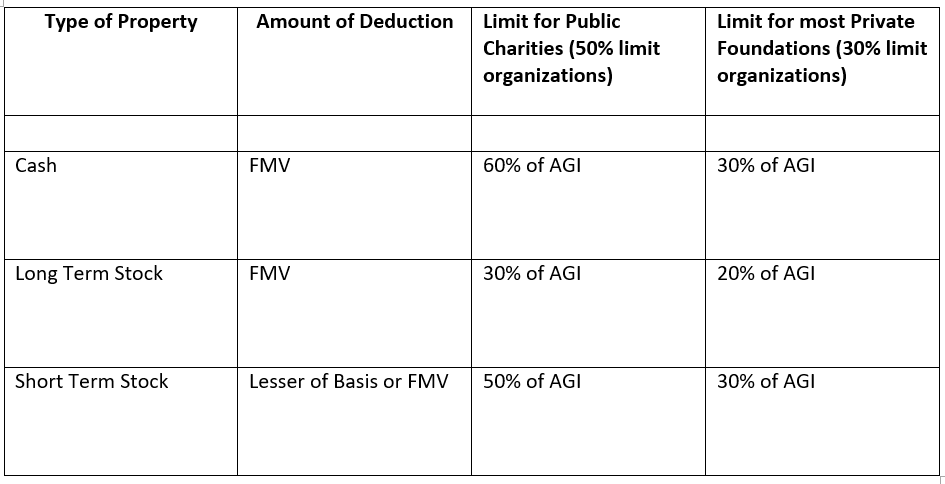

Cash up to 60%*

PUB 526 pg.3 & pg.13 limitations.

Report on Schedule A – Itemize deductions. Can deduct up to 50% of AGI (60% for 2018 moving forward). 30% private foundation.

Donating to a public charity short-term depreciated property – able to deduct basis.

Long term deduct up to 30% FMV.

Private foundation long term appreciated property FMV to 20%, short-term deduct basis up to 30% under AGI.

AGI 100,000 –over all limit 60,000. FMV long-term = 30%. (public charity) Cost = 50%

Charitable contributions deductible for AMT purposes (no add back list).

Donating a Stock/PTP that is a part of a taxable corporate acquisition:

IRS and the Anticipatory assignment of income doctrine

If the gain is considered to be “ripened”, then its assumed the donor has sold the stock/partnership interest and then made a cash contribution to charity subject to the 60% AGI limit for a public charity

Whether the gain is “ripened” requires a specific detailed analysis, subject to interpretation of a number of court cases, is not within our scope and should be determined by clients CPA or attorney

Ferguson v. IRS Page 28 - 33 for the anticipatory assignment of income doctrine

http://www.ustaxcourt.gov/InOpHistoric/FERGUSON.TC.WPD.pdf

Long-Term Capital Gain Property

For gifts of long-term capital gain property, the donor can generally claim a federal income tax charitable deduction for the fair market value of the property. To take a simple example, assume Jill Donor has held publicly traded stock for more than one year. The stock is valued at $10,000, which Donor bought for $1,000, i.e., the stock has a cost basis of $1,000. If Donor makes a gift of this stock to a qualified charitable organization, she can claim a deduction for the full fair market value of the stock, $10,000.

Short-Term Capital Gain Property

For short-term capital gain property, the value of the federal income tax charitable deduction is limited to the cost basis. Another example: assume Jill Donor held publicly traded stock for 364 days. The stock is valued at $10,000, which has a cost basis of $1,000. If Donor makes a gift of this stock to a qualified charitable organization, she can claim a deduction for only the cost basis of the stock, $1,000.

As you can see, it’s generally advisable to delay a gift of appreciated property until the long-term holding period can be met.

Donors receive an immediate tax deduction when they make a charitable contribution to a donor-advised fund. Deductions include up to 60% of adjusted gross income (AGI) for gifts of cash and up to 30% of AGI for gifts of appreciated securities, mutual funds, real estate and other assets. There is a five-year carry-forward deduction on gifts that exceed AGI limits.

There are also tax advantages when contributing specific assets, like long-term appreciated securities. By donating appreciated stock held for more than one year to a donor-advised fund, philanthropists can avoid or reduce capital gains taxes. In the hypothetical example below, a donor has $100,000 in long-term appreciated stock and its original purchase price [cost basis] was $10,000

As soon as you make a donation, you are eligible for an immediate tax deduction, just as you would by donating to another public charity. Your tax deduction may depend on the type of donation.

Cash donation - If you donate cash, via check or wire transfer, you're generally eligible for an income tax deduction of up to 60% of your adjusted gross income.

Long-term appreciated assets - Donating long-term appreciated securities potentially allows you to maximize capital gains tax advantages, which could help you reduce taxes and ultimately give more to charity. If you have long-term appreciated assets, such as stocks, bonds or real estate, you have an opportunity to further maximize your deduction. By donating these types of assets directly to charity, you generally won't have to pay capital gains, and you can take an income tax deduction in the amount of the full fair-market value, up to 30% of your adjusted gross income (AGI).

What are the charitable contribution deduction limits?

When is a gift complete for charitable contribution purposes?

You can deduct your contributions only in the year you actually make them.

Time of making contribution. Usually, you make a contribution at the time of its unconditional delivery.

Checks. A check you mail to a charity is considered delivered on the date you mail it.

Stock certificate. A properly endorsed stock certificate is considered delivered on the date of mailing or other delivery to the charity or to the charity's agent. However, if you give a stock certificate to your agent or to the issuing corporation for transfer to the name of the charity, your contribution isn't delivered until the date the stock is transferred on the books of the corporation.

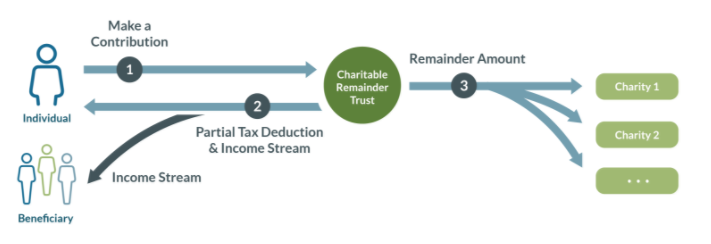

What is a Charitable Remainder Trust (CRT)?

A charitable remainder trust is a “split interest” giving vehicle that allows you to make contributions to the trust and be eligible for a partial tax deduction, based on the CRT’s assets that will pass to charitable beneficiaries. You can name yourself or someone else to receive a potential income stream for a term of years, no more than 20, or for the life of one or more non-charitable beneficiaries, and then name one or more charities to receive the remainder of the donated assets.

There are two main types of charitable remainder trusts:

· Charitable remainder annuity trusts (CRATs) distribute a fixed annuity amount each year, and additional contributions are not allowed.

· Charitable remainder unitrusts (CRUTs) distribute a fixed percentage based on the balance of the trust assets (revalued annually), and additional contributions can be made.

Contributions to CRATs and CRUTs are an irrevocable transfer of cash or property and both are required to distribute a portion of income or principal, to either the donor or another beneficiary. At the end of the specified lifetime or term for the income interest, the remaining trust assets are distributed to one or more charitable remainder beneficiaries.

What is a Charitable Remainder Annuity Trust (CRAT)?

Note: Taxpayers receive an immediate income tax deduction based on the present value of the remainder interest left to the charity.

What is a Charitable Remainder Unit Trust (CRUT)?

What’s a Net Income Makeup Charitable Remainder Unit Trust (NIMCRUT)?

How are distributions from CRTs taxed?

Form 5227 - page 13

Inclusion of Amounts in Recipients' Income

If there are two or more recipients, each will be treated as receiving his or her pro rata share of the various classes of income or corpus. Amounts distributed by a charitable remainder annuity trust or a charitable remainder uni-trust have the following characteristics in the hands of the recipients:

First, as ordinary income to the extent of ordinary income for the current year and undistributed ordinary income for prior years of the trust. Ordinary income is computed without regard to any net operating loss deductions under section 172. See the Ordering Rules for Ordinary Income next.

Second, as capital gains to the extent of the trust's undistributed capital gains. Undistributed capital gains of the trust are determined on a cumulative net basis without regard to any capital loss carrybacks and carryovers. See the Netting Rules, Ordering Rules for Capital Gains and Losses and Carryover Rules later for capital gains.

Third, as nontaxable income to the extent of the trust's nontaxable income for the current year and undistributed nontaxable income for prior years.

Fourth, as a distribution of trust corpus. For this purpose, trust corpus means the net FMV of the trust assets less the total undistributed income (but not loss) in each of the above categories.

If a CRT is fully invested in tax-exempt municipal bonds; will the distributions be fully tax exempt?

Municipal bond income received by the recipient will be federally tax exempt and depending on their state of domicile, possibly state tax free also.

How do I determine the charitable contribution deduction for contributions to a CRT?

**60% for cash to public charity

What is a Charitable Lead Trust (CLT)?

A CLT is essentially a CRT in reverse. First, the charity receives an income stream, then, at the end of the specified trust term, which can be for a term of years, for the lifetime of the donor, or for the lifetimes of the donor and the donor’s spouse, any income and principle remaining in the CLT can either revert back to the donor or pass to other non-charitable beneficiaries named in the trust.

What is the tax status of private foundations?

Every organization that qualifies for tax exemption as an organization described in section 501(c)(3) is a private foundation unless it falls into one of the categories specifically excluded from the definition of that term (referred to in section 509(a)). In addition, certain nonexempt charitable trusts are also treated as private foundations. Organizations that fall into the excluded categories are institutions such as hospitals or universities and those that generally have broad public support or actively function in a supporting relationship to such organizations.

Do private foundations pay income tax on their investment income?

Internal Revenue Code section 4940 imposes an excise tax of 2 percent on the net investment income of most domestic tax-exempt private foundations, including private operating foundations. Some exceptions apply. An exempt operating foundation is not subject to the tax. Further, the tax: is reduced to 1 percent in certain cases.

This tax must be reported on Form 990-PF, Return of Private Foundation. Payment of the tax is subject to estimated tax requirements. For more information concerning payment of estimated tax, see the Instructions for Form 990-PF. Nonexempt private foundations are also subject to this tax, but only to the extent that the sum of the 2 percent tax plus tax on unrelated business income, applied as if the foundation were tax-exempt, is greater than income tax liability for the year.

Example. A taxable private foundation had an income tax liability for 2002 of $10,000. If the foundation were tax exempt, it would have a $4,000 liability for tax on net investment income and a $7,000 liability for tax on unrelated business income. The foundation is liable under section 4940 for $1,000, the amount by which the sum of the tax on net investment income and the tax on unrelated business income ($11,000) exceeds the amount of income tax liability ($10,000).

Are contributions to private foundations fully tax deductible?

Donations to a private foundation are tax deductible up to 30% of adjusted gross income (AGI) for cash, and up to 20% of AGI for appreciated securities, with a five-year carry forward. Consult with your tax advisor about the deductibility of your contributions.

Can a retirement account be gifted to charity?

If a charity is named as beneficiary to a retirement plan, the assets will pass to the charity tax free when the owner of the plan passes away. Retirement plans cannot be gifted without an income tax consequence while the account owner is alive (Only exception would be QCDs from IRAs).

What is the difference when contributing long-term assets vs. short-term assets to charity?

When donating long-term assets, you are able to take a deduction on the full FMV of the stock, while with short-term property the maximum deduction would only be the basis in the stock.

What is IRC 4944?

Donors receive an immediate tax deduction when they make a charitable contribution to a donor-advised fund. Deductions include up to 60% of adjusted gross income (AGI) for gifts of cash and up to 30% of AGI for gifts of appreciated securities, mutual funds, real estate and other assets.

As soon as you make a donation, you are eligible for an immediate tax deduction, just as you would by donating to another public charity. Your tax deduction may depend on the type of donation.

Cash donation - If you donate cash, via check or wire transfer, you're generally eligible for an income tax deduction of up to 60% of your adjusted gross income.

Long-term appreciated assets - Donating long-term appreciated securities potentially allows you to maximize capital gains tax advantages, which could help you reduce taxes and ultimately give more to charity. If you have long-term appreciated assets, such as stocks, bonds or real estate, you have an opportunity to further maximize your deduction. By donating these types of assets directly to charity, you generally won't have to pay capital gains, and you can take an income tax deduction in the amount of the full fair-market value, up to 30% of your adjusted gross income (AGI).

https://www.irs.gov/charities-non-profits/charitable-organizations/donor-advised-funds

Charitable contributions made to qualified organizations may help lower your tax bill. The IRS has put together the following eight tips to help ensure your contributions pay off on your tax return.

If your goal is a legitimate tax deduction, then you must be giving to a qualified organization. Also, you cannot deduct contributions made to specific individuals, political organizations and candidates. See IRS Publication 526, Charitable Contributions, for rules on what constitutes a qualified organization.

To deduct a charitable contribution, you must file Form 1040 and itemize deductions on Schedule A.

If you receive a benefit because of your contribution such as merchandise, tickets to a ball game or other goods and services, then you can deduct only the amount that exceeds the fair market value of the benefit received.

Donations of stock or other non-cash property are usually valued at the fair market value of the property. Clothing and household items must generally be in good used condition or better to be deductible. Special rules apply to vehicle donations.

Fair market value is generally the price at which property would change hands between a willing buyer and a willing seller, neither having to buy or sell, and both having reasonable knowledge of all the relevant facts.

Regardless of the amount, to deduct a contribution of cash, check, or other monetary gift, you must maintain a bank record, payroll deduction records or a written communication from the organization containing the name of the organization, the date of the contribution and amount of the contribution. For text message donations, a telephone bill will meet the record-keeping requirement if it shows the name of the receiving organization, the date of the contribution, and the amount given.

To claim a deduction for contributions of cash or property equaling $250 or more you must have a bank record, payroll deduction records or a written acknowledgment from the qualified organization showing the amount of the cash and a description of any property contributed, and whether the organization provided any goods or services in exchange for the gift. One document may satisfy both the written communication requirement for monetary gifts and the written acknowledgement requirement for all contributions of $250 or more. If your total deduction for all noncash contributions for the year is over $500, you must complete and attach IRS Form 8283, Noncash Charitable Contributions, to your return.

Taxpayers donating an item or a group of similar items valued at more than $5,000 must also complete Section B of Form 8283, which generally requires an appraisal by a qualified appraiser.